What are sale-leasebacks?

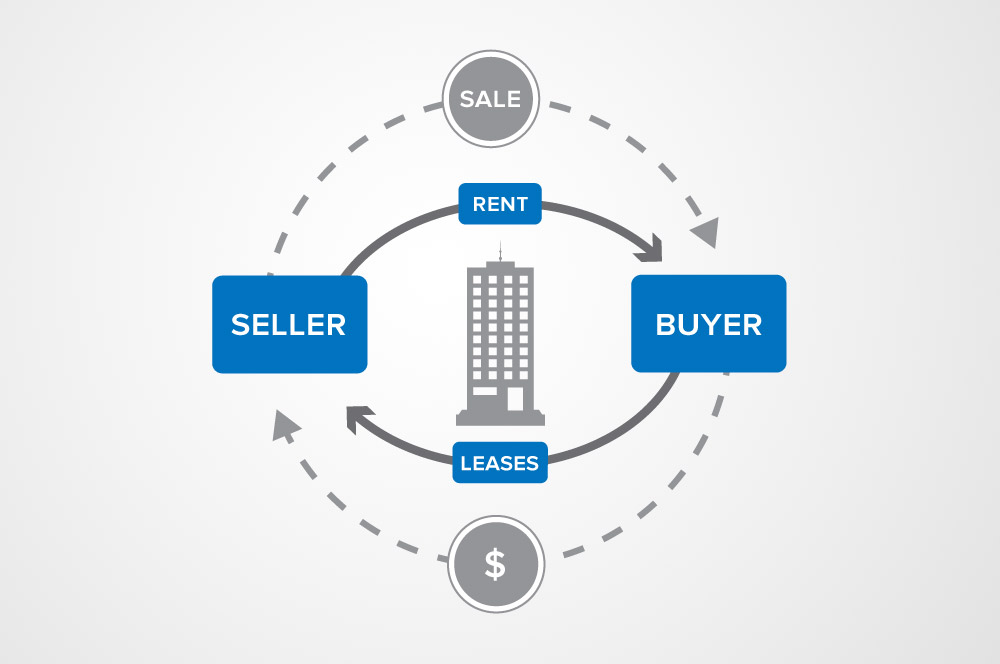

If you’re a commercial property owner and are looking to expand your business, a sale-leaseback may be an option for you. A sale-leaseback is when a property owner, who is also an operator, sells their property but continues to operate it by leasing back the property from the new owner.

A sale-leaseback arrangement is useful when a property owner needs or wants to gain access to cash, or wants to divest from a property but maintain the existing operation on the site. The sale-leaseback option will allow the property owner to access the equity in their property and reinvest the funds in the business. The lease agreement is executed at the same time as the sale. The seller of the property becomes the tenant while the buyer becomes the landlord.

SELLER BENEFITS

The transaction allows the business and property owner to increase their liquidity while reducing their debt. In addition, the immediate access to capital allows sellers to:

- Add additional units

- Upgrade equipment

- Invest in marketing, new team members, inventory, etc.

- Pay off business debt

Plus, the Seller/Operator:

- Can write off the entire lease payment instead of just the interest on the mortgage

- Is able to remain in the same location without incurring moving costs

- Can improve their income statement and balance sheet

- For example, if the property is sold any existing loan will be removed from the balance sheet

- Interest and depreciation are also removed from the property owner’s financials

- Can benefit from a lower cost of funds than debt financing through off-balance sheet financing

- Since sale-leaseback investors get the tax benefits of owning and depreciating the property, the seller can often be successful in obtaining a lower cost for capital than the cost for debt.

Seller Benefits & Opportunities Snapshot

- Access to capital

- Liquidity

- Stronger balance sheet

- Tax benefits

- Lower cost of capital

- Opportunity to grow your business

- Reinvest in your business

BUYER BENEFITS

Buyer Benefits & Opportunities

- The buyer and the seller have the unique opportunity to negotiate the lease with terms that meet their specific needs from the rental rate to a division in management responsibilities

- The buyer can ask for the opportunity to review the tenant’s financials to gauge their financial health and stability. In the majority of lease agreements already in place at the time of the purchase of a property, the buyer has less negotiating power to request access to financials.

- The property is already improved to meet the needs of the tenant

Attention Restaurant Owners:

Listen to my conversation with Jim White of Katz Sapper & Miller on how restaurant owners, who also own their properties, can benefit from sale-leasebacks.

This Episode: ‘Grow Your Restaurant’ Podcast with Barry Wolfe of Marcus & Millichap

All real estate investments carry risks. Nothing in this post shall be construed as tax or investment advice. A buyer and their tax, financial, legal, and construction advisors should conduct a careful, independent investigation of any property to determine to your satisfaction the suitability of the property for your needs.

#NetLeasePro #NNN #CRE #Retail #Sale-Leaseback#NetLease #CREInvesting #STNL #BarryWolfe