August retail sales grew 4.6% year-over-year (unadjusted), and up by 0.4% month-over-month, excluding automobile dealers, gasoline stations and restaurants.

As of August, the three-month moving average was up 4.1% year-over-year versus 3.5% in July.

While retail trends continue looking good, tariff talks are having an impact.

“While consumer attitudes about the economy indicate some retreating optimism, the bottom line is that consumer spending remained resilient in August and continued to be a key contributor to U.S. economic growth,” NRF Chief Economist Jack Kleinhenz said. “Trends remain strong, but August grew somewhat slower than July, which could reflect consumers’ concerns about the unpredictability of trade policy. It is too early to assess the impact of the new tariffs that took effect at the beginning of this month, but they do present downside risks to household spending.”’

YOY August Winners (in descending order):

- Grocery and beverage stores were up 4.9% YOY but down 0.2 percent month-over-month seasonally adjusted.

- Sporting goods stores were up 3.8% YOY and up 0.9 percent month-over-month seasonally adjusted.

- Health and personal care stores were up 2.9% YOY and up 0.7 percent month-over-month seasonally adjusted.

- Clothing and clothing accessory stores were up 2.3% YOY but down 0.9 percent month-over-month seasonally adjusted.

- General merchandise stores were up 2.2% YOY but down 0.3 percent month-over-month seasonally adjusted.

YOY Losers:

- Electronics and appliance stores were down 2.9% YOY and unchanged month-over-month seasonally adjusted.

- Building materials and garden supply stores were down 0.6% YOY but up 1.4 percent month-over-month seasonally adjusted.

- Furniture and home furnishings stores were down 0.1% YOY and down 0.5 percent month-over-month seasonally adjusted.

Online & Other Non-Store Watch:

- Online and other non-store sales were up 14.3 percent year-over-year and up 1.6 percent month-over-month seasonally adjusted.

What do you think about the latest numbers and category trends?

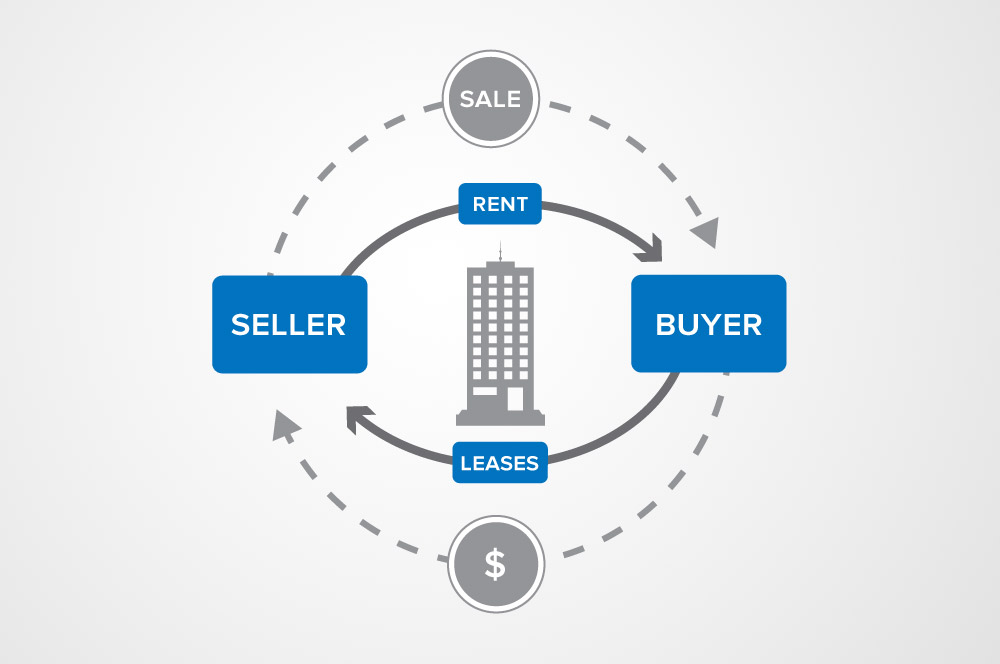

All real estate investments carry risks. Nothing in this post shall be construed as tax or investment advice. A buyer and their tax, financial, legal, and construction advisors should conduct a careful, independent investigation of any property to determine to your satisfaction the suitability of the property for your needs.

MONEY:

MONEY:

delivery

delivery