Macy’s is Our Wolfe Pack Retail Ratings 2018 Most Valuable Player

Macy’s has had a rough last couple of years but they didn’t give up and have fought tooth and nail to make their way back. To do so, the iconic retailer has:

- Gone all-out with its store-within-a-store concept and partnered with leading digitally-native brands, including Facebook

- Hired employees to be influencers

- Acquired disrupter Story

- Launched a new partnership with b8ta for a brand-agnostic tech store within its store

- Tackled the look-and-feel of its stores and invested approximately $200 million this year on 50 of its best stores to add new lighting, flooring and other fixtures (via CNBC)

- Diversified into the healthy off-price trend. Macy’s has opened about 165 Backstage stores within its stores. The company reports 2x more shopping trips, with basket sizes up an average of 30%. (via CNBC)

- Accommodated for omnichanneling by creating BOPIS (Buy Online, Pickup In Store) lines in the hopes customers that pickup their online purchases in-store will also add a few more items to their purchase

- Updated and upgraded its app and rewards program which now allows non-credit card holders to earn points, and offers other cool things like an augmented reality furniture shopping tool

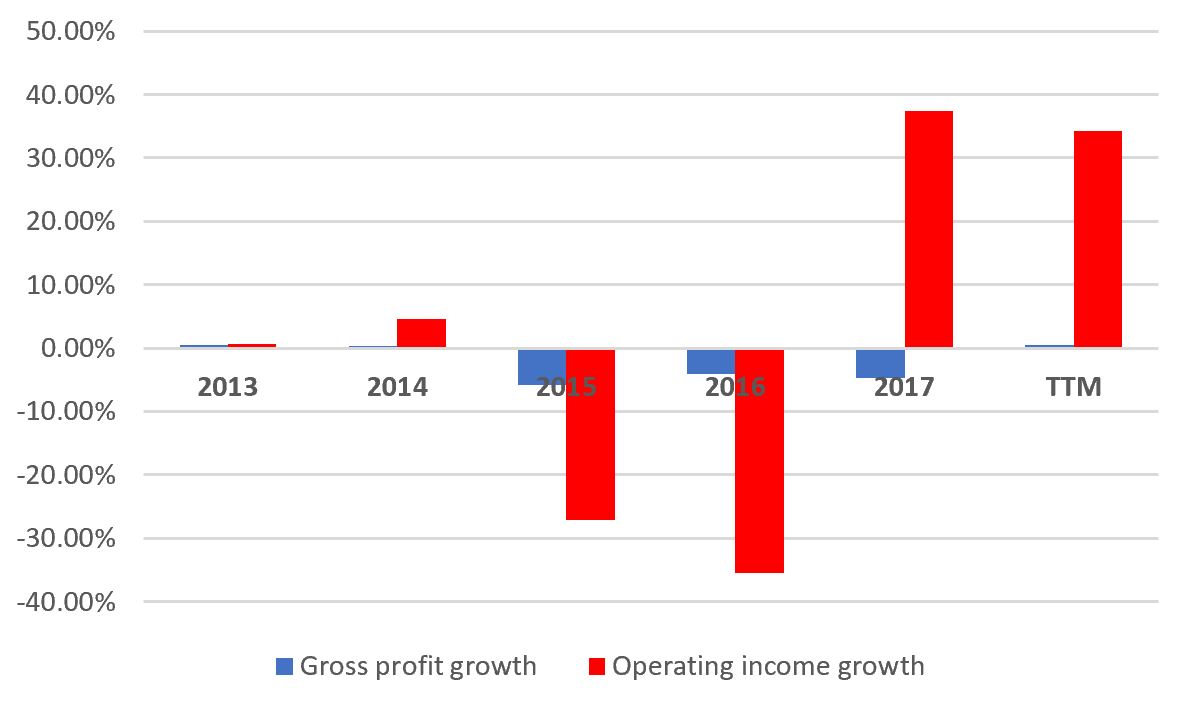

The results seem to be paying off. Macy’s:

- Expects its mobile sales will reach $1 billion by the end of the year

- Reduced its debt in the last seven quarters from $6.9 billion to $5.5 billion

- Has experienced growth at the same-store and company-wide levels (see graphics below)

Sales at Macy’s stores open for at least 12 months (on an owned basis, as a %)

(Data source: eMarketer; Graphic: Wolfe Retail Group)