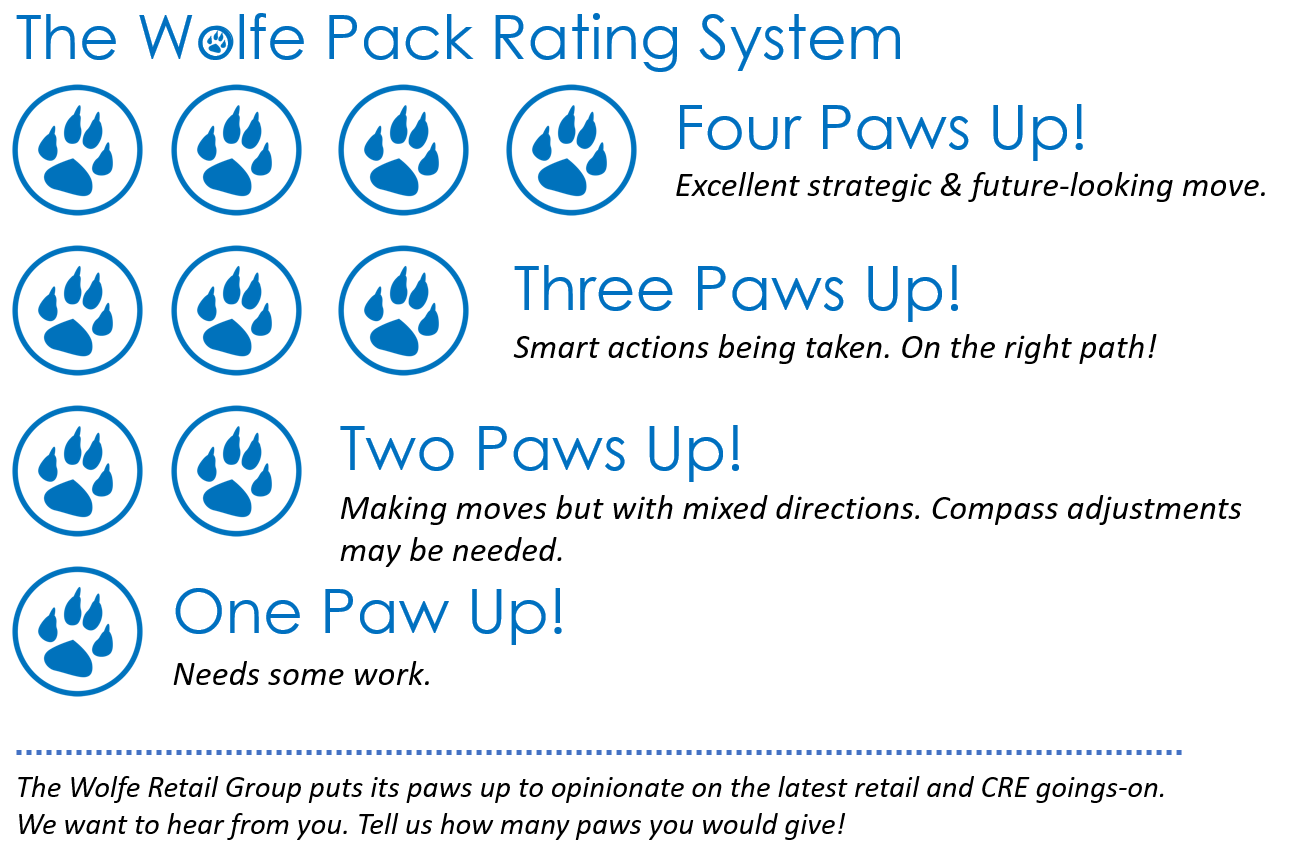

We’re giving Panera Bread Four Paws Up for their commitment to continuous innovation and evolution while staying true to who they are as a brand.

As an example of their willingness to innovate, Panera recently grew their omni-channeling capabilities by expanding its delivery program to ~13,000 drivers and employees, up from 10k in 2017, making delivery available from 1,300 locations, in 897 cities, in 43 states using their app or website.

Delivery is driving their digital sales which currently account for 30% of total sales, including kiosk orders. Unlike other chains that have turned to 3rd party  delivery partners, which can take a significant cut (up to 30%!), Panera has developed their own fleet to control the process and profit end-to-end. (Think, pizza delivery but for bakery-cafe set.)

delivery partners, which can take a significant cut (up to 30%!), Panera has developed their own fleet to control the process and profit end-to-end. (Think, pizza delivery but for bakery-cafe set.)

In addition, they’ve extended their technology to include mobile ordering and Rapid PickUp®, have a commitment to 100% clean food, and have one of the largest loyalty programs in the industry with over 25 million members (APR ’17).

As a result, Panera has been one of the most successful restaurant companies in history. Before the JAB acquisition in July 2017, Panera was the best-performing restaurant stock of the past 20 years, delivering a total shareholder return up 86-fold from July 18, 1997, to July 18, 2017, compared to a less than twofold increase for the S&P 500 during the same period.

Panera’s vision isn’t solely focused on technology and delivery.

In late 2017, Panera further enhanced its brick-and-mortar commitment by acquiring Au Bon Pain Holding Co. Inc., parent company of the 304-unit Au Bon Pain bakery-café chain. The acquisition reunites Panera and Au Bon Pain, and enhances Panera’s positioning and growth opportunities in new real estate channels, including hospitals, universities and transportation centers.

Excluding the Au Bon Pain acquisition, Panera grew its brick-and-mortar footprint through franchise and company-owned location growth with:

2017 Franchise-Owned*:

- Outlets at the Start of the Year: 1,099

- Outlets at the End of the Year: 1,112

- Net Change: +13

2017 Company-Owned

- Outlets at the Start of the Year: 901

- Outlets at the End of the Year: 931

- Net Change: +30

(*Source: FranchiseChatter.com)

In their last public quarterly report in APR 2017 (the same month in which they entered into an agreement to be acquired by JAB), the company reported that company-owned comparable net bakery-cafe sales increased 5.3%, franchise-operated comparable net bakery-cafe sales increased 0.3%, and system-wide comparable net bakery-cafe sales increased 2.6% compared to the same period in fiscal 2016.

Be a part of the Panera success model. See our extraordinary selection of single-tenant Panera properties from across the country here: https://wolferetailgroup.com/available-properties-for-sale/