Walmart Vs. Amazon – The Battle of The Retail Giants

What’s their next move?

Post by Barry Wolfe

Did you see this one coming?

Sam’s Club is building a small-format concept that will be “centered on convenience and a digital experience” stocking only 1,000 to 2,000 skus. (Read story here: http://www.supermarketnews.com/retail-financial/sam-s-club-develops-small-format-concept)

On the same day, it was revealed that the company opened the first of its new e-commerce fulfillment centers in Memphis, TN.

Interestingly, both announcements were made by Jamie Iannone, CEO of SamsClub.com and EVP of membership and technology.

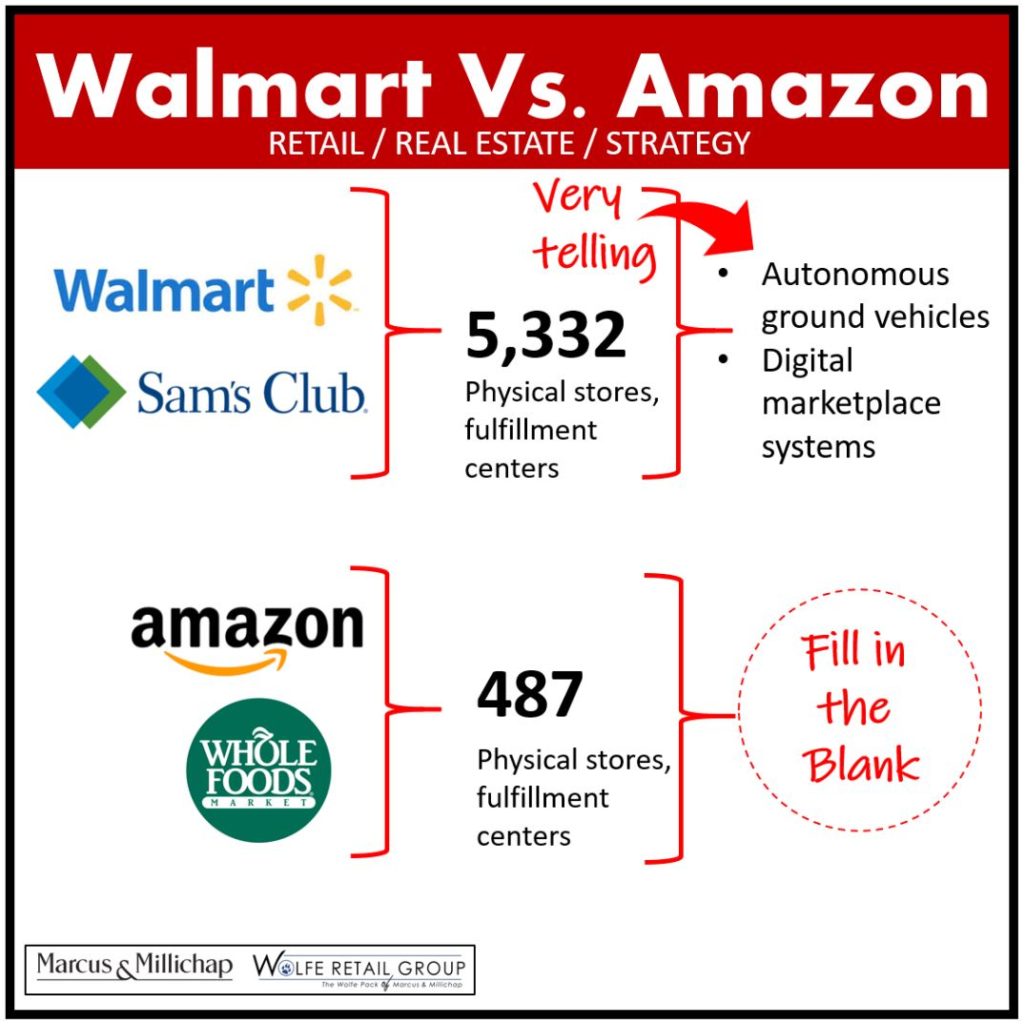

I see this as a sign of things to come as e-commerce, fulfillment centers and brick-and-mortar locations merge in an omnichanneling landscape. In so many ways, Walmart is ahead of the game on this one. They have 660 Sam’s Clubs ands 4,672 Walmarts in the U.S. for a total of 5,332 sites. Amazon has 75 fulfillment centers and 412 Whole Foods.

This tells me that Walmart is in an excellent position to achieve penetration across a broader spectrum of markets, those that are e-commerce-friendly to slow adapters, from the coasts to rural areas. And, it also tells me that Amazon isn’t likely to sit by on such an unbalanced equation. They are likely to make a move that will allow them deeper market penetration, faster deployment, and access at a localized level. What will give them that advantage?

My inclination is toward drugstores. They’ve tackled food through Whole Foods, whose consumers mirrored their own customer profile and gave them grocery market entry via a physical location in a demographically-aligned trade area.

Next, would be medicine/drugstores/beauty. I’ve said this before as it gives them entry into a growing market segment (beauty) while gaining a foothold in a recession-resistant category (medical/drugstores). I’m not the only one thinking this is their next move. CVS is rolling out delivery for prescriptions and some over-the-counter medicines as it is said to be bracing for Amazon’s possible disruption. (Read more here: https://www.cnbc.com/2018/06/19/cvs-starts-drug-delivery-as-it-braces-for-expected-amazon-disruption.html) The drugstore’s merger with Aetna makes it an even more interesting player as Amazon has been making various supply-side moves.

Interestingly, Walmart just recently filed for several patents including a patents system for accessing medical records stored on a #blockchain, and just last month, Walmart was awarded two patents; one for a digital marketplace system that customers may use to resell items and the other geared towards facilitating customer deliveries to restricted areas using autonomous ground vehicles. Read full story here: https://www.ccn.com/walmart-patents-system-for-accessing-medical-records-stored-on-a-blockchain/

What will be Walmart’s next move? What will be Amazon’s next play?

Let me know your thoughts here: https://www.linkedin.com/feed/update/urn:li:activity:6415976467259224064

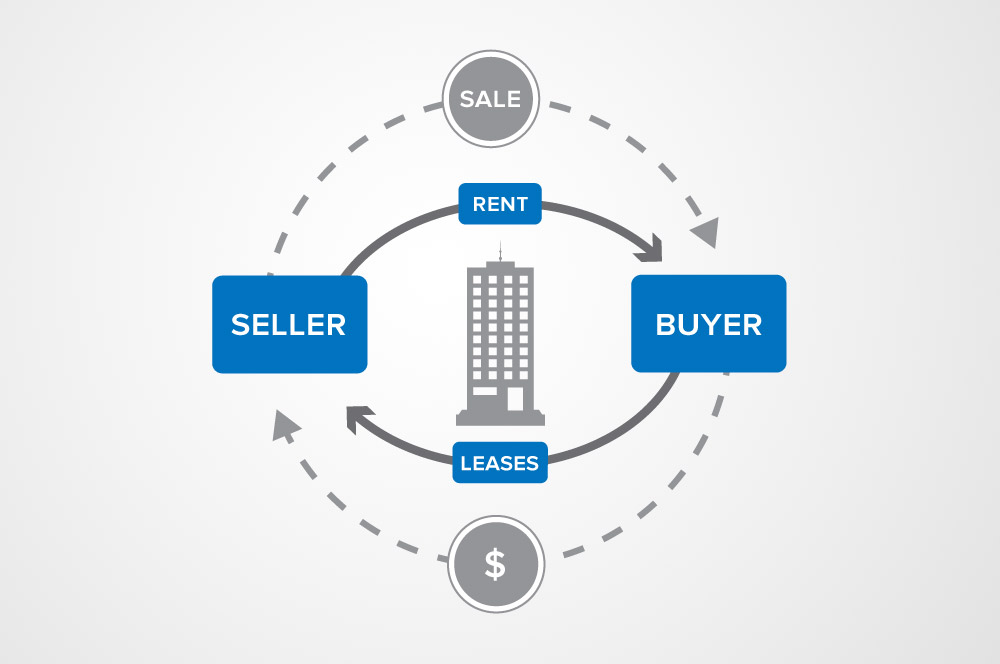

MONEY:

MONEY: